As interest rates climb, temporary buydowns have become an avenue that some sellers and buyers may consider. A 2-1 buydown program is a concession offered by sellers to incentivize buyers. A 2-1 buydown essentially allows borrowers to make a lower mortgage payment for the first two years of their loan, and payments go back up on the third year of the loan.

If you’re seeking ways to reduce your monthly mortgage payment before purchasing a home, a 2-1 buydown could be a potential avenue. We’ll explore exactly what a 2-1 buydown is, how it works, and the pros and cons to help you make a decision.

What is a 2-1 Buydown?

A 2-1 buydown program is a type of financing offer to reduce your interest rates for the first two years of a mortgage. If you opt for a 2-1 buydown, that means as a buyer, your interest rate is reduced by 2% the first year and 1% the second year.

By the third year of the mortgage term, the interest rate goes back to the original interest rate on the loan. But with a 2-1 buydown, buyers have reduced payments for the first two years.

How does a Temporary Buydown Work?

A temporary buydown is a closing concession available for primary and second home purchases. It enables borrowers to have a lower interest rate for the first two years of purchase and ease into their mortgage payments.

The builder or seller will fund a temporary buydown, but it’ll need to be included as an agreement in the purchase contract, and the real estate agent negotiates it during the offer process. The prepaid sum is paid during closing into the escrow account.

The lump sum is held in a custodial escrow amount and is applied to the buyer’s payment. The buyer will have a reduced monthly payment, and the difference in interest rates comes out of the escrow account. The first year, the interest rate is lowered by 2 percentage points and 1 percentage point the following year.

Temporary Buydown Scenario

Let’s look at a temporary buydown scenario* to help you understand what it’ll look like in action.

Let’s say you’re buying a $450,000 house with a 20% down payment for a mortgage loan of $360,000 and an interest rate of 7% and APR of 7.094%. A monthly principal and interest (P&I) payment would be about $2,395.05.

With a 2-1 buydown, your interest rate would decrease by 2% from the original rate for the first year. So, with a 5% interest rate, your monthly P&I amount would be $1,932.56.

The following year, your interest rate would go down by one percentage point from the original rate, taking it to 6%. The monthly P&I amount you’d be paying would be $2,158.38.

Your payment would then be at the original 7% interest rate from the third year onwards, taking your monthly P&I back to $2,395.05.

Bear in mind that this scenario doesn’t factor in taxes and insurance, so your actual monthly payment amount will vary, but you can see the difference between years 1 and 2 versus year 3 and after. Running these different scenarios can help you better forecast what you’ll be paying for the first 2 years versus the third year onwards to understand if it’s the right decision for you.

Pros and Cons of a Temporary Buydown?

The first thing to point out with a temporary buydown is just that, it’s temporary. Initially, it can be a pro that you’re paying lowered mortgage payments the first two years. However, if your income doesn’t match the payment amount in the third year of the loan, it can become a serious con. That’s why it’s essential to consider the impact of the monthly payments once they resume at the original interest rate from the third year onwards.

A temporary buydown can benefit both sellers and buyers, but it’s more likely to occur in a buyers’ market where there are many properties available but not enough buyers. For buyers, this is a bridge for a market with high rates and gives them an opportunity to buy now, when interest rates are high, with the ability to refi later if rates go down. If they don’t go down and continue to go up, then at least they’ve locked in a lower rate right now. For sellers, it enables them to move properties faster and keeps them from staying on the market too long. For buyers, the reduced monthly payments can help manage initial housing expenses.

Better to do a Temporary Buydown or buy the rate down forever?

There are some crucial differences between a temporary buydown and buying down the interest rate. With a temporary buydown, it’s just that – temporary. You’ll lower the interest rate for a short period of time, but borrowers pay the regular interest rate moving forward on the loan.

However, buying down the interest rate means borrowers pay an additional charge to receive a lowered interest rate. Buying down the interest rate is useful for reducing your long-term interest rate and monthly payments.

Whether you choose to do a temporary buydown or buy the interest rate will depend on first if you qualify for the mortgage loan at the regular interest rate. Then how much money you’re willing to invest short-term and long-term for your home and what your income will look like over time. So before deciding, it’s crucial to run the figures for both scenarios to understand what will be most beneficial to you initially and in the long term.

Connect with me, I’m here to help.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link

Four Things That Help Determine Your Mortgage Rate

Four Things That Help Determine Your Mortgage Rate

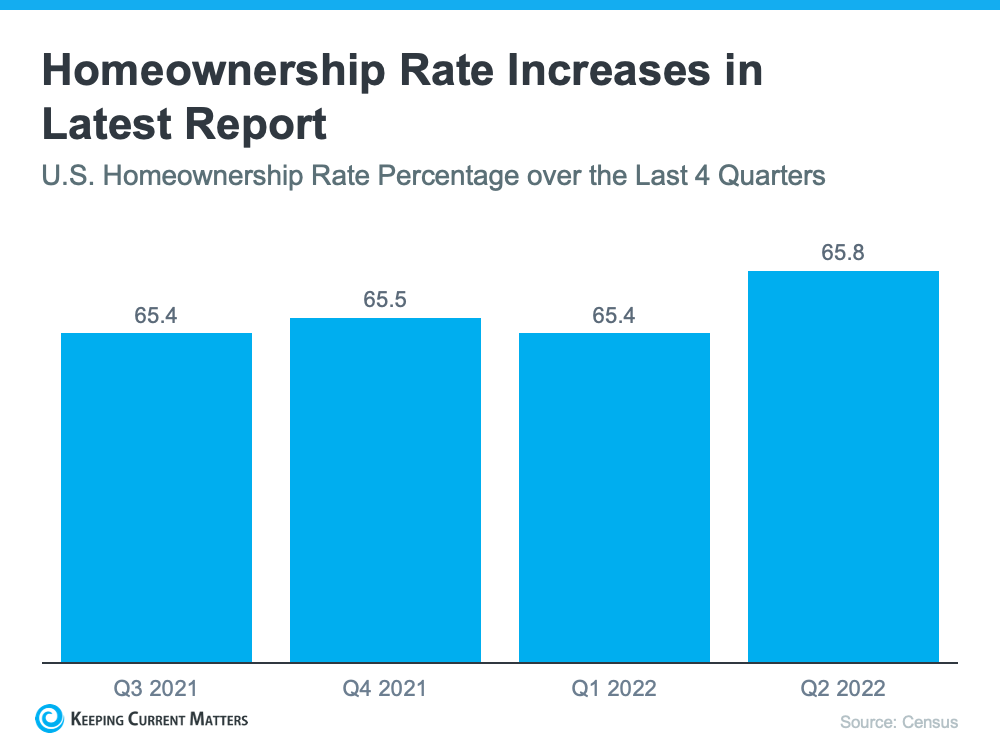

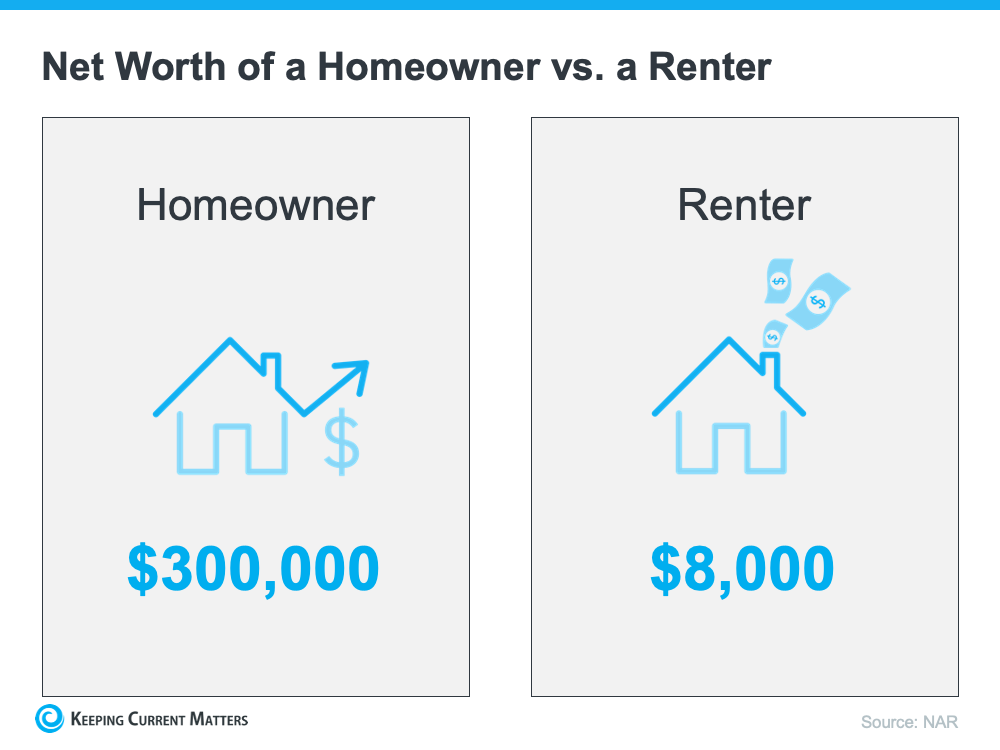

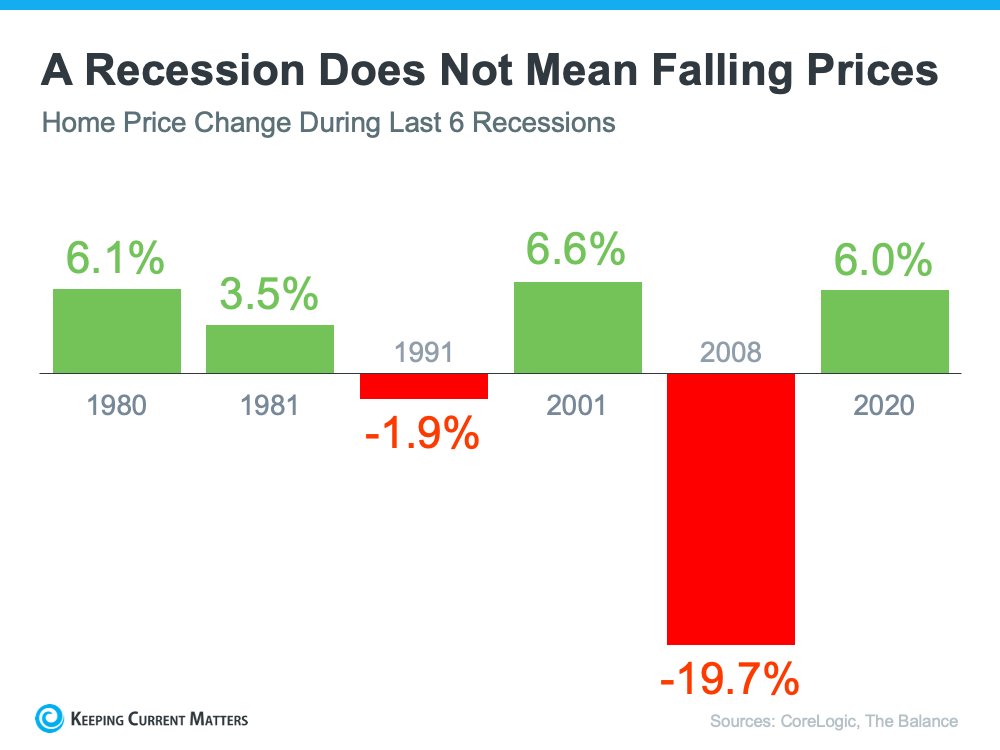

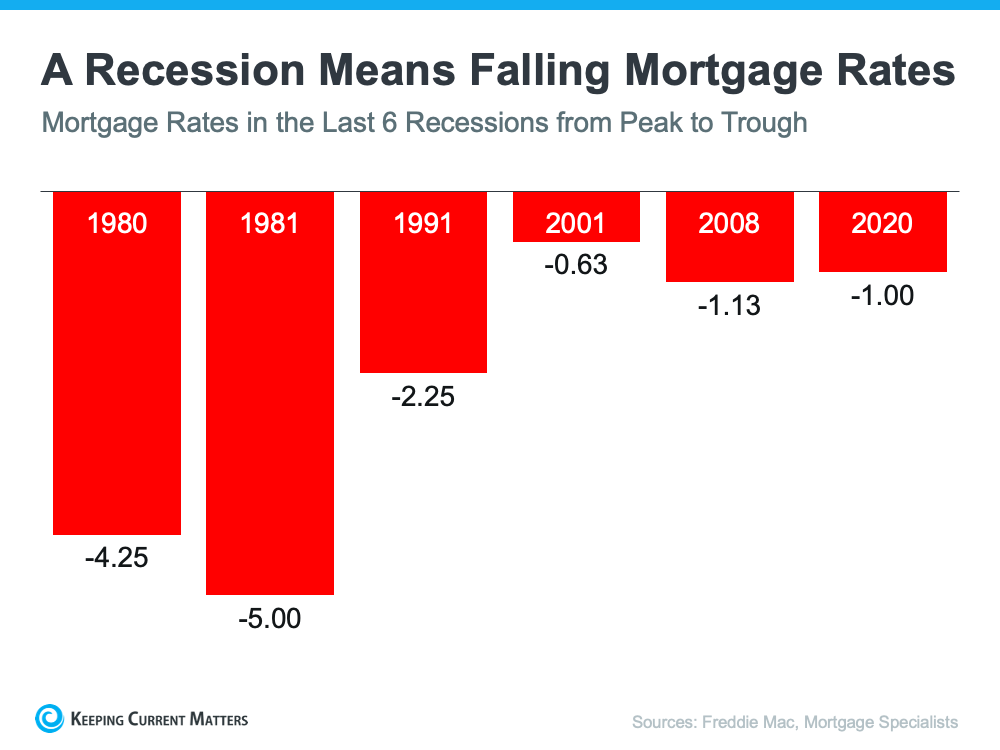

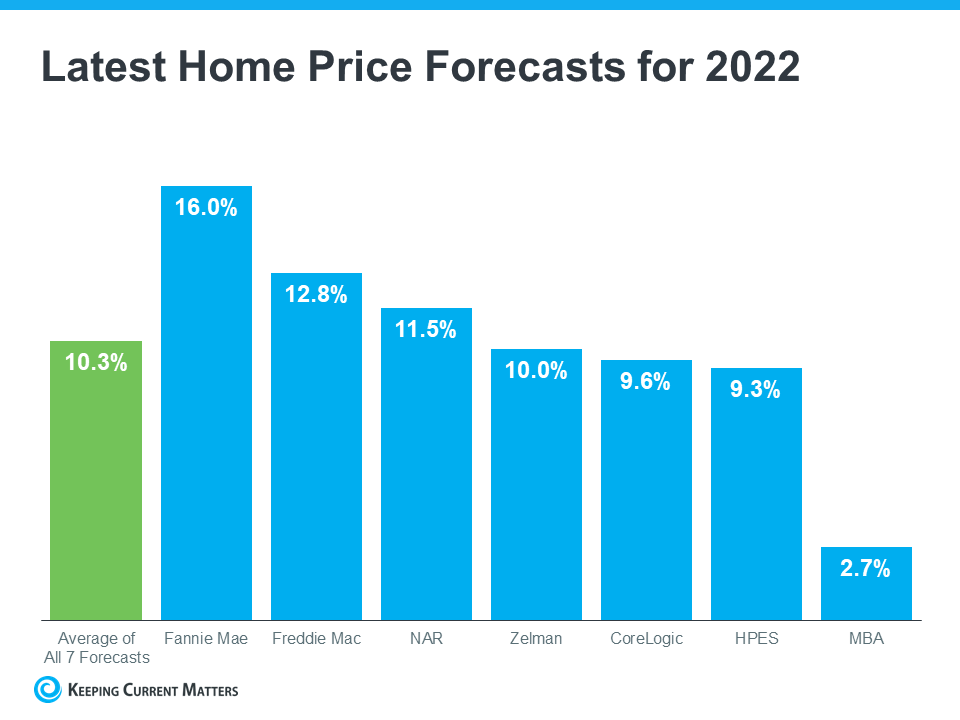

Whether you’re a potential homebuyer, seller, or both, you probably want to know: will home prices fall this year? Let’s break down what’s happening with home prices, where experts say they’re headed, and why this matters for your homeownership goals.

Whether you’re a potential homebuyer, seller, or both, you probably want to know: will home prices fall this year? Let’s break down what’s happening with home prices, where experts say they’re headed, and why this matters for your homeownership goals.

Home Partners of America

Home Partners of America